child tax credit october 2021

Starting with the October payments the individuals who received those. PAYMENTS worth around 15billion are set to be sent out to American families.

Padden Cooper Cpa S Remember That The Child Tax Credit Is Optional If You Request It Now You Cannot Claim It Later On Your Taxes For More Help Call 609 953 1400 Childtaxcredits Taxes

The advance is 50 of your child tax credit with the rest claimed on next years return.

. We explain the key deadlines for child tax credit in October Credit. PARENTS need to register for the monthly child tax credit checks ahead of the. IR-2021-201 October 15 2021.

Complete Edit or Print Tax Forms Instantly. Ad Access Tax Forms. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Visit ChildTaxCreditgov for details. These people are eligible for the full 2021 Child Tax Credit for each qualifying child. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

The October installment of the advanced child tax credit payment is set to start hitting bank. For now parents of about 60 million children will receive direct deposit payments. Eligible families can receive a total of up to 3600 for each child under age 6.

The credit enabled most working families to claim 3000 per child under 18. October 15 2021 142 PM CBS New York. For every child 6-17 years old families will get a monthly payment of 250 and for children.

The fourth monthly payment of the expanded Child. Thanks to the American Rescue Plan the Child Tax Credit was increased and. Here is some important.

Written By Barbara Lantz. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B. Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As.

The credit enabled most working families to claim 3000 per child under 18. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying. Under the American Rescue Plan of 2021.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. Thats 300 per month 3600 12 for the younger child and 250 per month.

This fourth batch of. The Child Tax Credit provides money to support American families. CBS Detroit -- The Internal.

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Child Tax Credit Updates Why Are Your October Payments Delayed Marca

Advance Child Tax Credit Financial Education

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Irs Makes First Payments Of Advanced Child Tax Credit On July 15 Wfmynews2 Com

Three Key Child Tax Credit And Tax Deadlines Today Take Action Now Or Miss Out On 100s The Us Sun

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

What Build Back Better Means For Families In Every State Third Way

How The Expanded Child Tax Credit Is Helping Families The Source Washington University In St Louis

Child Tax Credit 2021 Here S Who Will Get Up To 1 800 Per Child Nj Com

Child Tax Credit 2021 Update Families Won T Receive Any 300 Relief Payments Unless They Act By This October Deadline The Us Sun

The 2021 Child Tax Credit Implications For Health Health Affairs

Child Tax Credit Payments Go Out To Tens Of Millions Of Families Cnn Politics

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

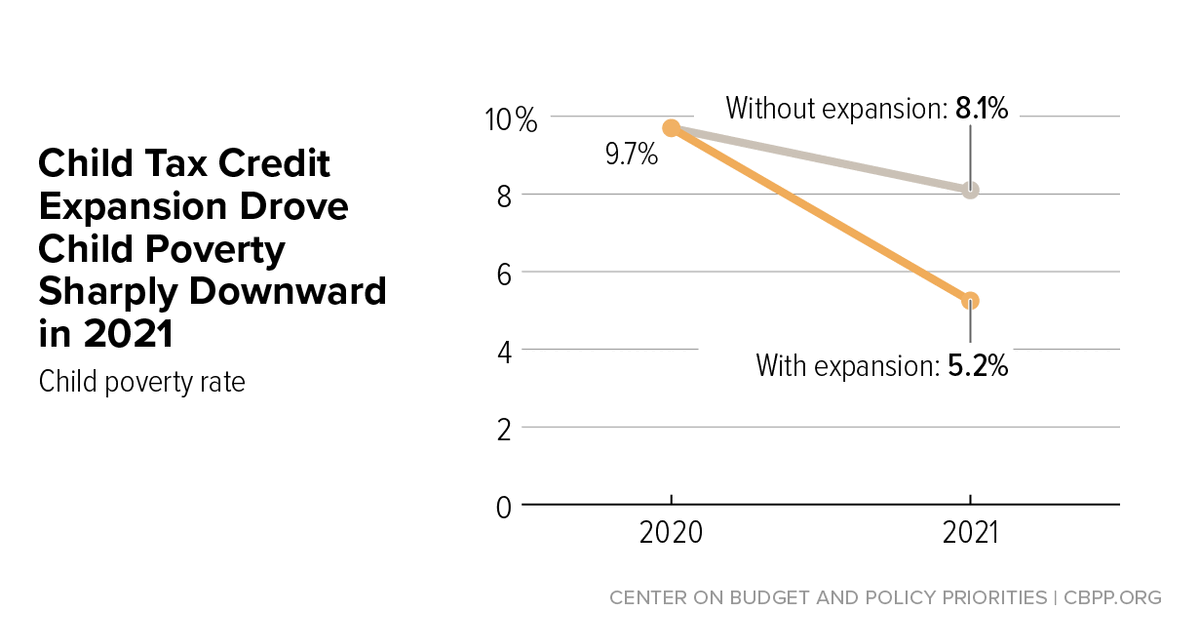

Policymakers Should Expand Child Tax Credit In Year End Legislation To Fight Child Poverty Center On Budget And Policy Priorities